Pre-settlement Funding Resources

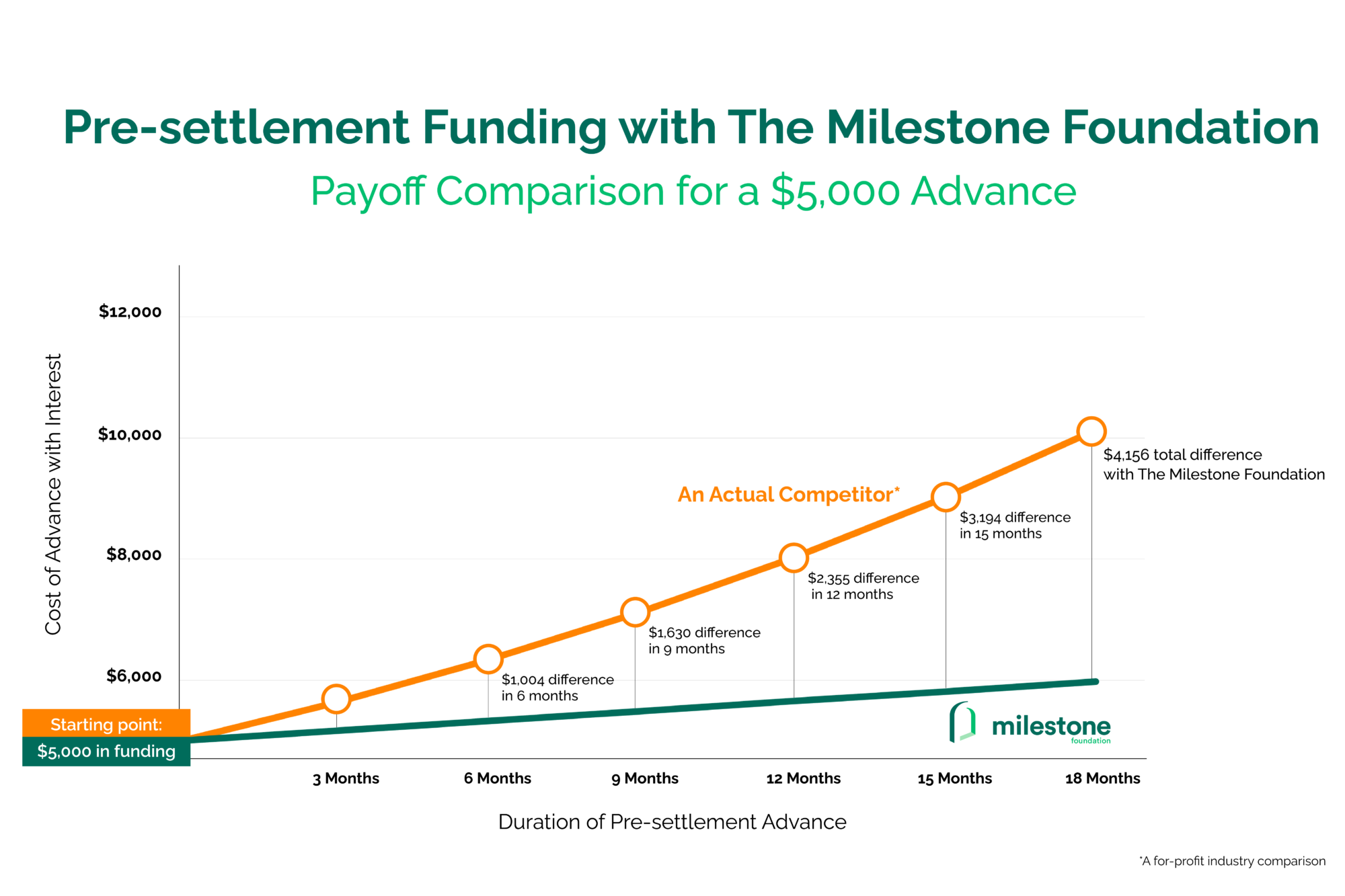

Plaintiff advances at 10% simple interest

In an effort to bring fairness to the non-recourse industry, we provide pre-settlement advances with low, simple interest. We have gathered some resources to help explain what we do, how we plan to grow, and why the third-party funding industry needs us.

What is Non-recourse Funding?

When seeking financial assistance from a third party, plaintiffs generally have two borrowing options: recourse and non-recourse. How these two options differ is related to how borrowers are obligated to pay back the money they owe.

With both types of monetary advances, the company has the right to take any assets that have been designated as collateral to secure the advance. If a person receives a recourse advance during litigation and loses his or her lawsuit and cannot pay back the debt, the company is allowed to seize that person’s assets — possibly his or her home, vehicle, and other valuable property. The company can even sue to garnish his or her wages or otherwise file collection actions.

On the other hand, if a person receives a non-recourse advance from a company and loses his or her lawsuit, that person is not personally obligated to pay back the company with these other assets. In other words, if a plaintiff loses the lawsuit, the non-recourse company loses its money because the funding company has agreed in advance to only recover against the lawsuit.

Non-recourse advances are generally more attractive than recourse advances, because borrowers do not risk losing their other property if they lose their lawsuit. Unfortunately, there’s often a catch to borrowing from the unregulated non-recourse industry. Companies can charge astronomical interest rates — sometimes as high as 50 to 100 percent. The risk these companies take is how they often validate their high rates.

Either way, it’s the plaintiff who is likely to suffer the financial burden in the long run. Financial assistance is an absolute necessity for some people when they need money during litigation. When they elect to borrow a non-recourse advance, however, there is a possibility that their settlement recovery amount can become less than the advance amount plus interest. Debt and injury-related bills continue to pile up, and the plaintiff could be left with no recovery and a huge debt.

The Milestone Foundation provides an alternative option for plaintiffs, so families can see their lawsuit through to the end without the burden of staggering interest rates. We provide financial assistance with low, simple interest — the lowest in the industry.

Frequently Asked Questions

Navigating litigation can be expensive and overwhelming. Many plaintiffs, their family members, and even attorneys have asked us great questions about our foundation, as well as more general questions around the non-recourse advance process, interest rates, and much more. To better assist anyone looking for capital during litigation, we have compiled answers to our most frequently asked questions below.

How is The Milestone Foundation different?

The for-profit, non-recourse industry is unregulated, so the cost of capital is often exorbitant for plaintiffs. We’ve seen interest rates anywhere from 50 to 180 percent on these advances that are often crucial for individuals awaiting settlement. The Milestone Foundation is a 501(c)(3) tax-exempt nonprofit organization that’s aiming to change that norm. We work closely with applicants to provide the minimum amount a plaintiff needs to support them during litigation. We’re also here to give you advice and equip you to make the best financial decisions possible — not just to provide financial help and then forget about you.

How do you calculate interest?

We offer capital at a 10% simple interest rate. Simple interest is calculated as a percentage of the original amount of capital (called the principal). While simple interest is calculated on the principal amount of a financial advance, compound interest is calculated on the principal amount AND the accumulated interest of previous periods.

How soon can I receive funding?

Many companies in the non-recourse industry tout their ability to provide plaintiffs with financial assistance very quickly — some as fast as 24 hours. These for-profit companies will advance as much and as frequently as possible, because they will make a staggering return on the interest. For us, it’s not about speed. We know that any amount a person borrows will cost him or her down the road, so we take extra time to consult with families to make sure we’re giving them only what they need. Our turnaround time varies case by case, and we definitely take into consideration time-sensitive or urgent issues. You could receive funds from the Foundation in about 1-2 business days once your request is approved. The careful consideration and attention to details is worth it in the long run.

How do I apply for a pre-settlement advance?

First, let your lawyer know that you are going to apply. Then, there are two ways to get started. Click here to fill out the online form. A member of our team will reply to you as quickly as possible. You can also call our Foundation toll-free at (855) 836-2676 to speak with someone right away.